Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

SUMMARY

- The Fed is still on investor’s side, in our view.

- The Trend is slowing but remains positive.

- Crowd is near a pessimistic extreme, as tariffs set off recession worries.

Since our last update of our ‘Three Tactical Rules’ on February 4th, equity markets have been under pressure as the S&P 500 has retraced more than 23% of the rally that started October 2023. In just over a month, the Trump Administration’s tariff policies have created a headwind for equity markets, as both business and investor confidence has eroded. What was once viewed as a thriving economy with accelerating growth prospects due to the potential of deregulation and tax cuts has been replaced with a growing probability of recession or stagflation. Currently, financial markets are increasingly pricing in a recession, as fed fund futures are expecting the fed to cut interest rates three times this year. Since both monetary and fiscal policy can operate with a lag, we are not expecting the full impact of these decisions to be known until at least the second half of 2025. Hence, we turn to the three ‘Tactical Rules’ – Don’t Fight the Fed, Don’t Fight the Trend, and Beware the Crowd at Extremes – to help guide us for the next three months. Currently, the Three Rules collectively rate a “green light”, an improvement from the “flashing green light” in our last update.

‘Don’t Fight the Fed’: Still on the Investor’s Side - FLASHING GREEN

After cutting interest rates by 100 basis points in the last three meetings of 2024, the Fed decided to hold interest rates steady at its January FOMC meeting. We believe that the Fed will remain on hold at its upcoming March 19th meeting, despite the economic data deteriorating since January. Fed Chairman Powell was recently quoted as saying “we do not need to be in a hurry and are well-positioned to wait for greater clarity” before cutting rates.

The Fed has the luxury of waiting because prior to last quarter’s 2.3% GDP print, GDP had grown at 3% or faster 4 out of 5 quarters. The one hiccup occurred in Q1 2024, when GDP slowed to 1.6%. The Fed did not panic back then and waited on the data, and we believe that will be the case this time around as well. In our opinion, the Fed is meeting half of its dual mandate of price stability and full employment. We think the Fed still has more work to do to reach its 2% inflation target, with core PCE at 2.6%. Tariff policies thus far have acted as a headwind to the Fed making additional progress towards this goal. Conversely, the unemployment rate is at 4.1% and we believe even with governmental job cuts, should not reach 4.4% based on economist forecasts, which by historical statistics would still be considered ‘full’ employment.

The Fed wants to make sure that fiscal policy based on tariffs does not derail its efforts to fight inflation before it cuts again, in our opinion. Thus, we believe that the Fed could be on hold for the foreseeable future. Despite the Fed holding rates steady, it is not hiking rates and driving up borrowing costs, so it remains on the investor’s side, in our opinion.

Internationally, the Bank of England (BOE) resumed lowering its policy rate in February after pausing to ensure that inflation did not get out of control. The UK’s economy continues to slow, but the central bank has yet to be able to fully tamp down inflation, which increases the likelihood the central bank will pause again in March, in our opinion. Meanwhile, the European Central Bank (ECB) has cut its deposit rate by 150 basis points since last May and is approaching its 2% inflation target, as CPI was 2.4% in February. While the speed of monetary policy easing is different at each of the major central banks, we believe most of the major central banks are fully aligned with our mantra of “Don’t Fight the Fed” … and thus are on the investor’s side. The Bank of Japan (BOJ) is the one exception, as it is currently raising interest rates after leaving them artificially low for an extended period.

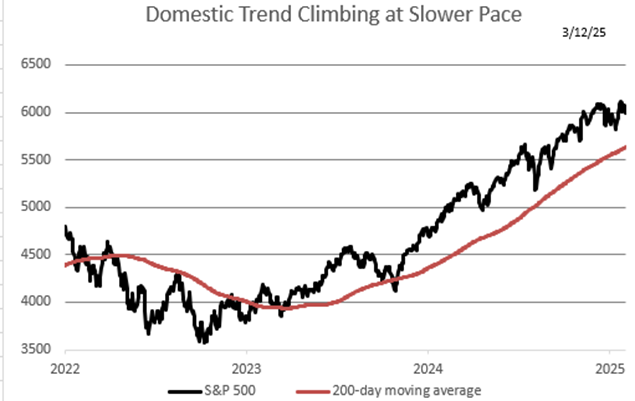

‘Don’t Fight the Trend’: Domestic Trend is Slowing but Remains Positive - GREEN LIGHT

The trend on the S&P 500, which we define as the 200-day moving average, has slowed as the index has pulled back since hitting an all-time high in February. The S&P 500 is down nearly 10% from its high as recession worries intensify. Currently, the trend is rising at a healthy 17% annualized rate but will quickly fall into the single digits if current levels remain in place over the next two weeks. While the path getting to this point has been painful, we welcome the slower ascent of the trend. This is because a more gradual positive trend actually possesses better historical odds of above-average returns in our proprietary analysis. Historically, a positive trend is good for future stock returns, and we believe that this time will not be different even with the threat of tariffs. Thus, domestically our rule of “Don’t Fight the Trend” is signaling a “green light”.

International Trend: Recent Improvement Warrants an Upgrade to Positive - GREEN LIGHT

Internationally, the trend of the MSCI All Country World ex-US index has accelerated since our last update. The international primary trend is currently rising at a 7% annualized rate, which is a substantial improvement relative to its flat trend just five weeks ago. The outperformance of international equities thus far this year has led to the improvement in our rating. We concluded in our last update that if the MSCI All Country World ex-US index remained above 336, the trend would remain positive for the next three months. Well, thus far the international trend has outshined our expectations. A positive trend increases the probability of receiving above average returns over the next 3 to 6 months. Hence, we have upgraded the international trend to a “green light”.

Beware of the Crowd at Extremes: Nearing Pessimistic Extreme - GREEN LIGHT

We regard Crowd Sentiment as the contrary indicator of the Three Tactical Rules. The chart below shows a measure of investor sentiment as calculated by Ned Davis Research. When the line is high it shows extreme optimism, and when it is low, extreme pessimism. This is our preferred data source to measure investor psychology, though we use our own analytical framework from which to draw conclusions on sentiment.

Unlike our previous update, both the NDR Daily Sentiment and the NDR Weekly Sentiment Polls have crossed into the extreme pessimism zone. Historically, we have given more weight to the Weekly for this publication despite incorporating both measures of sentiment in our overall rating. The Daily tends to be a good indicator of the investors’ ‘real time’ view of financial markets, while the Weekly gives longer term perspective of the Crowd. In the review of Daily Sentiment, its current level of 20 ranks in the 4th percentile of all occurrences in the dataset– meaning that 96% of all historical readings since 1995 were less pessimistic than today. To us, this is the archetypal definition of a ‘pessimistic extreme’. While less stretched, the Weekly Sentiment level of 52 in the chart below still ranks in the 25th percentile of all occurrences. Given the deterioration of confidence implied by the percentiles of both polls, we believe that the Crowd is now at a pessimistic extreme, and thus is signaling a buying opportunity for equities. Hence, we have upgraded the Crowd to a “green light”.

Conclusion: The Tactical Rules Signal a Green Light - GREEN LIGHT

The tactical rules signal to us a “green light,” as the trend decelerates to a more sustainable pace, and the crowd becomes too pessimistic. The green light signal serves as a reminder that the repricing of the market has opened the door of opportunity for stock investors that have been on the sidelines. We believe that the pullback experienced due to tariffs sets the stock market up positively over the next 3 to 6 months, despite the volatility experienced thus far this year. Hence, we remain cautiously optimistic, and the tactical rules give us the confidence to maintain the portfolio’s composition favoring stocks over bonds. However, we acknowledge that the allocation between domestic and international stocks in our balanced portfolios may have to be tweaked.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.